Does the Lufthansa share still have wings?

NewsDeutsche Lufthansa is one of Germany’s best-known listed companies and is an international figurehead. But like all airlines, the pandemic has caused massive turbulence for the company. After more than 30 years, Lufthansa will have to leave the German leading index, the Dax, on June 22nd and will be relegated to the second stock exchange league, the MDax.

Here’s what you should know now before you buy Lufthansa shares:

How do you even get kicked out of the Dax?

The Dax includes the 30 largest listed companies in Germany. The criteria are the stock exchange turnover (trading volume) and the stock exchange value (market capitalization). In September, Deutsche Börse checked the composition of the index. There is also a quick check in March, June and December according to the fast-exit and fast-entry rules.

If a company falls below 45th place in the Dax in terms of market capitalization or exchange turnover, the company must leave the index according to the fast-exit rule. Any non-Dax company, which would rank at least 35th in the Dax according to these criteria, would then move up. The Dax founding member, Lufthansa, will have to leave because the fast-exit rule applies, namely in terms of market capitalization.

Market value shrunk

Lufthansa’s market value on the reporting date, the last trading day in May, was only around 5 billion euros. In comparison, the Dax giant, SAP, has a market capitalization of around 148 billion euros.

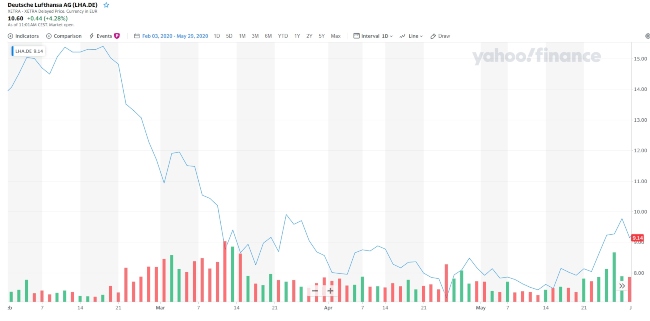

While it is true that the Lufthansa share had been falling slightly since November 2019, the Corona Pandemic and the lockdown have done extreme damage to the share, due to dramatically reduced air traffic. You can see just how drastic the share’s decline was in the chart below.

German State Aid

At this point, Lufthansa will no longer be able to fly solo. The German government has put together an aid package of 9 billion euros, in return for which the federal government will also get two positions on the supervisory board. The Lufthansa Supervisory Board has approved the rescue package, which will hopefully be followed by shareholder approval at an extraordinary general meeting on 25 June.

Since state aid alone won’t cut it, Lufthansa must also cut costs. Lufthansa’s fleet will be shrunk and thousands of jobs will be cut.

What does the expulsion mean for the share?

As it stands, their reputation has taken a big hit, as the Kranich-Airline was a proud founding member of the Dax. This could potentially scare off many investors, especially foreign investors. The share will also be removed from various Dax ETFs, which have now been restructured. This will also have an impact on the share price. (ETFs, or Exchange Traded Funds, replicate an index like the Dax. Incidentally, ETFs will soon be available in BUX Zero. You can read more about ETFs here).

Looking at this with a wider lens, the index ejection is rather insignificant when compared to the crisis wrought by the pandemic. The outlook for Lufthansa shares is looking bleak for the year. In an interview with the FAZ, Lufthansa CEO, Carsten Spohr, said that the figures for 2020 would be terrible.

What are the analysts saying?

The majority of experts are drawing a red card on this one. Citigroup remains pessimistic, having set a target of only 0.50 cents for the Lufthansa share at the beginning of June. On the flip side, US analyst firm Bernstein Research has left Lufthansa’s rating at “Market Perform” with a price target of EUR 10. Lufthansa CEO, Carsten Spohr, is still holding out hope as he bought 160,000 shares at the beginning of June at a price of 11.56 Euros.

The share is, of course, far from its previous high of 31 Euros (December 2017 due to the Air Berlin takeover). However, the Lufthansa share has often been quoted around 10 Euros, for example at the end of September 2016 and before that in June 2012. The share has always managed to crawl back up. We can, however, expect more volatility.

The success of LH will be at the mercy of the pandemic. If travel restrictions are significantly eased, and if a vaccine, or other effective treatment becomes available, the share could take off again. It also remains to be seen what effect the pandemic will have on business travel in the long run. Nearly half of the income of LH’s core network airlines, which also includes Swiss, Austrian Airlines and Brussels Airlines, comes from business travel. Corona will continue to be a cloud hovering over the business.

Who is actually moving up?

Lufthansa will be replaced in the Dax by the real estate group, Deutsche Wohnen, the second-largest private landlord in Germany. The largest German landlord, Vonovia, has been listed on the Dax for several years already, and you can buy both with BUX Zero.

Have a good flight!

All views, opinions and analyzes in this article should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.