5 good reasons to invest now

Investing knowledgeWhether you’ve got short, medium, or long-term goals for your money, investing can help you grow and build your wealth. Depending on your goals and time horizon, it can help you start a business, retire comfortably or pay for your children’s education. Let’s see how!

Main points:

- Investing allows you to grow your money with capital gains, dividends, and compound interests.

- Unlike saving, investing can help prevent your money from losing value against the damaging effects of inflation.

- The overall long-term rise in the markets along with new, free and simplified ways to access the stock exchange has made investing more accessible.

Make your money work harder

By investing your money, you’re making the choice to grow your wealth. Like a gardener, you sow a few seeds and hoping to see them sprout. Eventually, you may begin to generate returns in two simple ways: capital gains and dividends.

Capital gains

Capital gain is simply the growth in value of your investment. It’s the difference between the price you bought an asset, such as a stock and the price you sell it for (assuming it goes up in value).

Let’s look at an example. It’s 2016 and you decide to buy one LVMH share, which costs €153 at the time. In 2021, it’s now worth about €543. If you decided to sell the share, the capital gain is €390. Now imagine how much you’d make if you bought 20 shares.

Having said that, you should bear in mind that stocks can also decrease in value. That’s why you should always do your own research before you invest and adopt strategies to mitigate your risks, like portfolio diversification.

Dividends

If a company is profitable, it may decide to share those profits with shareholders. This is called a dividend. The amount of dividend and its distribution is decided by the company, which means you don’t always know how much you’ll get and when to expect it.

Some companies are known for their generous dividend policy. Even despite the chaos of 2021, companies like Sanofi and Vivendi have decided to hold or increase their dividend payout. Head over here if you’d like to know more about dividends.

Discover the power of compound interest

If you play the long game, your patience will be rewarded with a phenomenon called ‘compound interest,’ or ‘interest on interest.’ Albert Einstein called it “the most powerful force in the universe.” So, how does it work?

Let’s say you invest €1,000 annually in a fund that makes a 5% return in the first year. Now you have €1,050. You decide to leave that money in the fund. The next year, the fund returns another 5% and so on. After 30 years, thanks to the accumulation of interest, you’ll have €70,760. Interesting, right?

Compound interest isn’t a get-rich-quick scheme. It’s based on your ability to be patient over the long-term. However, the sooner you get started, the more interest you’ll earn, and the less you need to put in, to begin with.

Again, be aware that any market will have fluctuations in interest and returns. Your yield can increase and decrease.

Invest to fight inflation

As we have just explained, investing gives you the opportunity to make substantial returns over the long term. And by increasing your wealth like this, you can keep pace with the rising price of goods and services, known as inflation.

When day-to-day prices ‘inflate’, it means the purchasing power of your money goes down. The relatively low-interest rate on your savings account can’t make up for it, so investing is one way to help fight the power of inflation.

So why invest instead of saving?

To begin with, saving and investing are two different things. Ultimately, it’s about striking a balance. For example, it’s important to build up an emergency fund of savings, just in case. The good thing about saving is the risk of losing your money is very low. On the other hand, with interest rates at a historically low level, your money won’t grow.

For this reason, investing regularly over the long term is an effective way of building up wealth. Of course, future returns are not guaranteed (unfortunately it’s not magic!) And the risk of losing money is real.

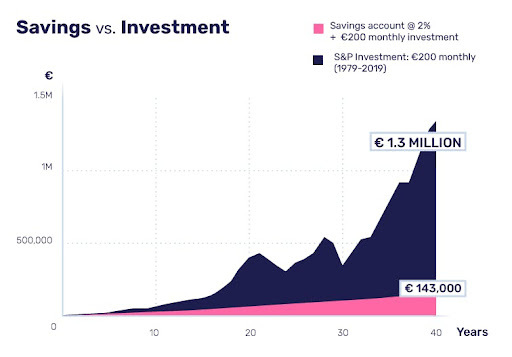

However, the graph* below shows the potential of investing regular sums of money and sticking to a monthly schedule.

Take advantage of reachable and overall rising markets

We’ve seen some crazy headlines in the last couple of years. “This was the fastest stock market decline ever,” followed a few months later by, “Stocks soar to new record highs.” If you follow the headlines, the stock market looks like a volatile place.

But if you zoom out, history shows that the stock market has been growing steadily for the last 30-40 years. For example, the American S&P 500 index has generated a return of around 7.5% every year since 1990. As for the CAC 40, the flagship index of France, its average return is around 6%. So, while the risks are real, the long-term opportunities are impressive.

Investing has never been so accessible

Before the digital age, investing was a lot more difficult. There were lots of middlemen, high fees and the markets were only available to a small group of people. Even access to business news was tedious.

Today, neo brokers like BUX offer platforms that simplify the investing process and cut out brokerage fees and other commissions (external fees and external implied fees might apply) that eat into your profits. Indeed, the fees involved in traditional investing can hamper investors on a smaller budget, whose costs end up higher than their profits.

Now you can invest with almost any amount. It’s all about knowing what you’re doing and deciding how much risk to take.

Invest in what matters most to you

When you invest in a company, you are showing support for their goals and projects. You can, for example, choose to invest in companies that share your values or make products that mean something to you. It could be innovative, visionary companies, or simply an area that interests you, like travel (TUI, TripAdvisor), luxury (LVMH, Kering), food (Beyond Meat, Danone), or even cars (Renault, Tesla).

In this case, investing isn’t just a way to help your money grow. It’s a real motivation to get involved with companies you believe in. Because, on the markets, all sectors are represented!

So, are you convinced to get started? Let’s jump into the second step and help you build a portfolio.

—

* The blue line of this chart shows the results you would have obtained by depositing a lump sum of €10,000 in savings account at the beginning of 2003, followed by €200 deposits each following month until November 2020, assuming that the bank applied the average overnight market interest rate each month. At the end of the period, the account balance would have amounted to €54,747, from a total investment of €52,800. The total return would therefore have been €1,947.

Source: https://www.euro-area-statistics.org/bank-interest-rates-deposits?cr=eur&lg=en

The red line indicates the results you would have obtained by investing the same amount on the same schedule in a fund replicating the MSCI World Index, a diversified stock index that tracks more than 1,500 stocks from 23 developed countries. Assuming the fund had reinvested the net dividends, at the end of the period the account balance would have amounted to €144,223, against the same total investment of €52,800. The total return would therefore have been €91,423.

Source: https://www.msci.com/end-of-day-data-search

The chart also shows the difference in volatility of the two options. The returns of the stock index have been much more volatile than those of the savings account. The calculation does not include fees, costs, or taxes. Past performance is not indicative of future results.

All views, opinions, and analyses in this article should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.