What exactly is a bear market?

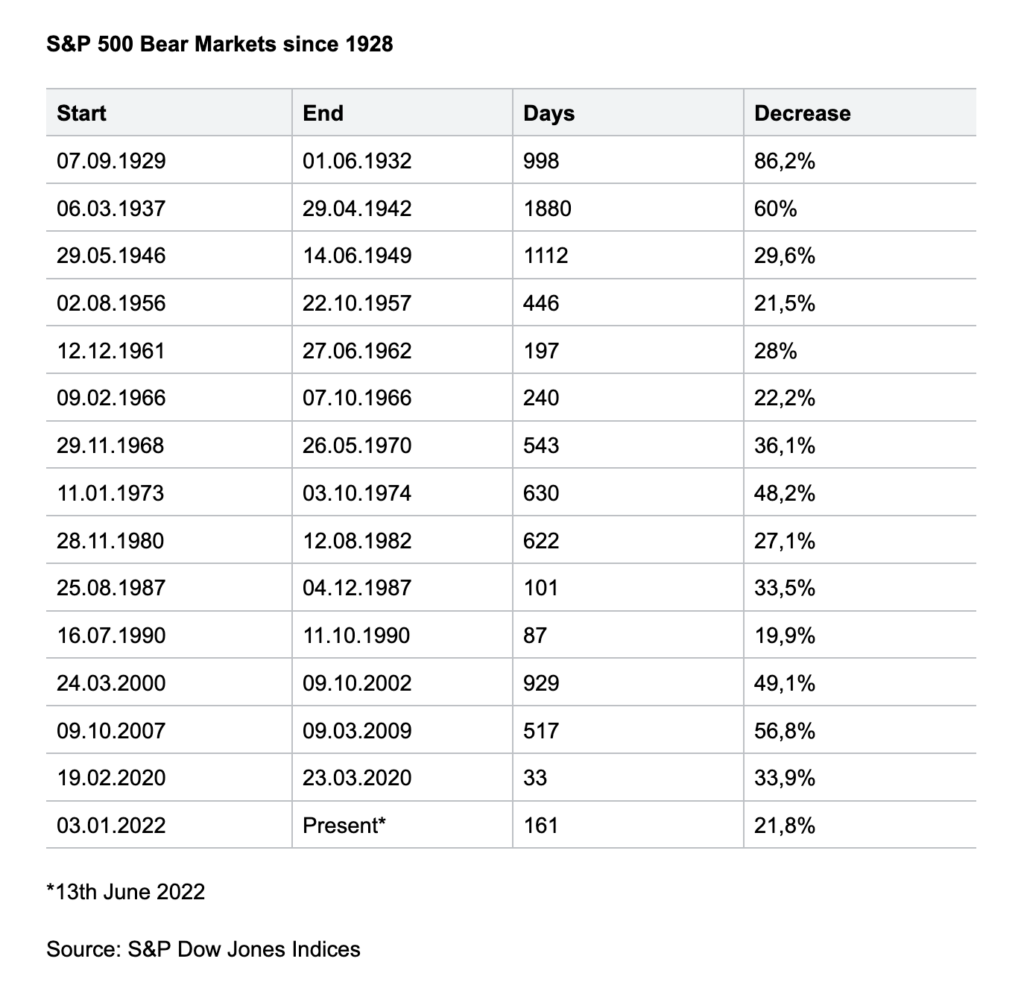

Investing knowledgeAnytime the market falls more than 20% over a 2 month period it officially becomes a bear market. From World War II to today, the S&P 500 has recorded 13 bear cycles… including the one we’ve just entered.

Since 13 June, the S&P 500 is officially a bear market, losing more than 21% in 2022. The Nasdaq is also down more than 30%. However, some analysts see an uptick on the horizon. JPMorgan and Credit Suisse have set 2022 targets for the S&P 500 that demand a 30% rise between now and the end of the year.

There are also different ways to view a bear market. Yes, prices are down, but to investors with cash, a number of well-regarded stocks are now cheaper than they were in January. US equities can today be bought at a discount, and the same is happening in Europe, with the EuroStoxx 50 losing more than 18% in 2022. The rest of the world is in a similar situation.

So, what do we do now? How should we proceed?

A bit of context

Our emotions make us feel stock market losses more intensely than gains. We previously said that the S&P 500 has fallen from its highs by more than 20%, but we cannot ignore the fact that the index has returned positive results, with dividends, for almost 70% in the last five years.

Even if your portfolio is well diversified and you have been investing for a while, it is likely that your situation has worsened, compared to this time last year. In that case, the best thing you can do is stay calm and stick with your long-term plan, without selling at a loss.

As the table below shows, bear markets are natural and have a beginning and an end. Which is all well and good, but what should you do now, considering the volatility caused by widespread inflation, rising interest rates, unresolved problems in supply chains and the war in Ukraine?

Good time to create an Savings Plan

We have seen that the markets are much cheaper than at the beginning of 2022 and that JP Morgan, the first banking institution in the United States, assures us that the doomsayers should not be listened to. If you invest a little each month, you dilute stock market volatility and benefit from what is known as “dollar cost averaging”, which in Spanish means “averaging costs”.

With BUX Zero you can invest automatically by creating your own Savings Plan. It’s simple and quick to set-up. First you choose a date, then add stocks and ETFs that interest you, before finally selecting the monthly contribution you want to make. You can also use fractional investing, which allows you to diversify at a much lower cost than buying whole ETFs or stocks.

Remember that the key to good investing is to always think long term. If you look at the price of the MSCI index from 1978 to now, made up of more than 1,500 companies from 23 developed countries, or the S&P 500 from 1871 to the present day, you will see that both have had their ups and downs, but that the world economy naturally tends to trend upwards, over time.

How to invest long term in this scenario?

That’s a good question. In this inflationary situation, value companies tend to do better than growth companies, although this is not always the case. Two sectors that are usually considered as growth sectors are technology and consumer discretionary. On the other hand, the financial, industrial, energy and basic consumption sectors are usually considered to be value sectors. Diversification is always important.

With BUX Zero you can also invest in various fixed income ETFs that provide exposure to corporate and government bonds. One of them is the USD Inflation-Linked Bonds ETF (Lyxor), which tracks the Bloomberg Barclays US Inflation Linked Bonds Index, an index based on AAA US bonds.

You can find them all in the ETF section of the app. Add a few to your Savings Plan, along with your favourite stocks, many of which are now priced much cheaper than in January. Oh, and remember that you can have several investment plans active at the same time!

Keep a cool head and think long term

It is important to remember the following when we are investing for the long term:

Contributing a monthly amount to a Savings Plan is a great way to avoid market volatility, build long-term wealth, and fend off inflation.

At BUX Zero you can create a Savings Plan using fractional investing, which allows you to build a well-diversified portfolio at a lower cost.

Keeping a cool head during spikes and dips often works better in the long run than reacting to day-to-day news, and trying to time the market. In any investment, it is best to continue with our plans, focusing on our long-term goals, with a horizon of five, ten or twenty years.

__

No views, opinions or analysis in this article should be construed as personal investment advice, and individual investors should make their own decisions or seek independent advice. This article does not meet the legal requirements to promote independence in investment research, and should be considered a marketing communication